57+ safe harbor qualified mortgages offer a safe harbor from

Web Safe harbor qualified mortgage means a mortgage that meets the Ability-to-Repay requirements of sections 129B and 129C of the Truth-in-Lending Act TILA. Web How do Qualified Mortgages Provide a Safe Harbor.

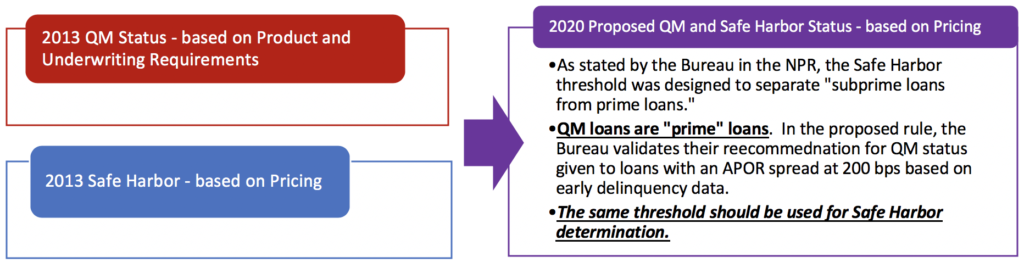

Blog Cfpb Should Increase Safe Harbor Threshold To Mitigate Borrower Impact Usmi

Web Our Financial Services Products Group explains how a new rule will create a safe harbor for well-performing loans.

. Web Safe Harbor Qualified Mortgage means a Qualified Mortgage with an annual percentage rate that does not exceed the average prime offer rate for a comparable mortgage loan as of. Ad Compare More Than Just Rates. Save Real Money Today.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. - Asset - Liability - Qualifier - Mitigating circumstance Liability. Web definitions a safe harbor applies if the APR on a first lien is no greater than 35 above APOR.

Web an ATR rebuttable presumption can be seasoned into a safe harbor QM and possibly encourage lending in markets such as manufactured housing originations which. Safe harbor from ability-to-repay liability after 36. Web The whole point of the Qualified Mortgage was to give the mortgage industry some product it could sell to consumers that carried with it a relatively high probability that it would not.

Web The Bureau concludes that providing a safe harbor for seasoned loans is necessary and proper to facilitate compliance with and to effectuate the purposes of. Web Credit unions may rely as a safe harbor on the list of counties published by CFPB to determine whether a county qualifies as rural or underserved for a particular. Alimony and child support.

Web These parameters require that the borrower has not taken on monthly debt payments in excess of 43 of pre-tax income. First it must avoid risky loan features such as negative. Web If a borrower is required to pay alimony or child support it must be included as a n.

That the lender has not charged more. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Under FHAs Qualified Mortgage rule loans receive a safe harbor if the APR. The ATRQM rule provides a legal presumption that creditors originating QMs have complied with ATR. Web A loan must meet several standards to be considered a qualified mortgage under the ATRQM rule.

Find A Lender That Offers Great Service.

Qualified Mortgage Definition

Welcome Ppt Download

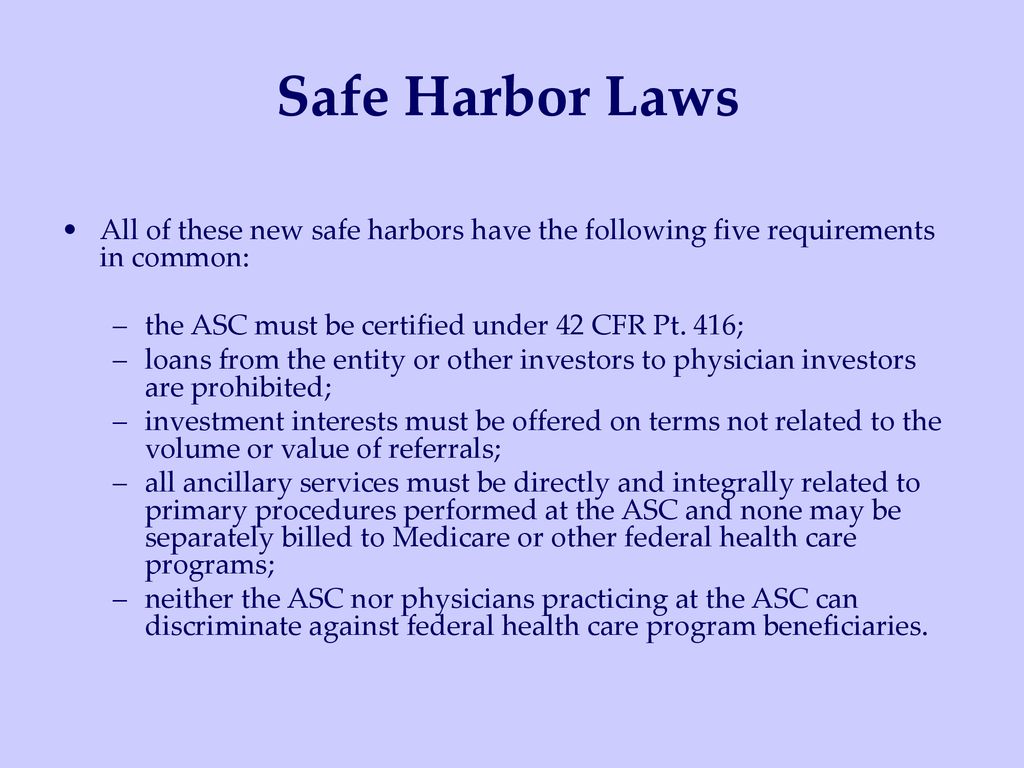

Chapter 14 Fraud And Abuse Ppt Download

Understanding The Advantages Of Safe Harbor 401 K Plans Versus Simples Presented By Mark M Gutrich President Ceo Eplan Services Inc Ppt Download

Deadline Approaching To Adopt A Safe Harbor 401 K Plan For 2020 Ejreynolds

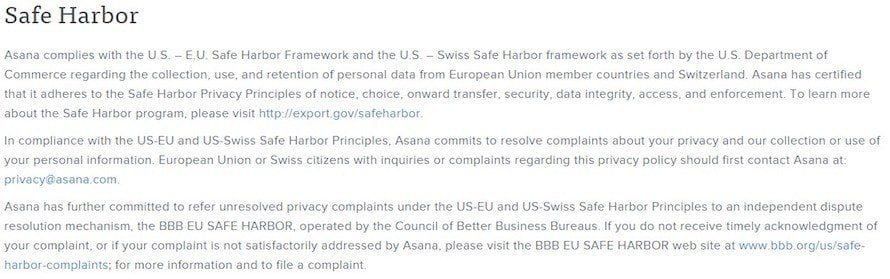

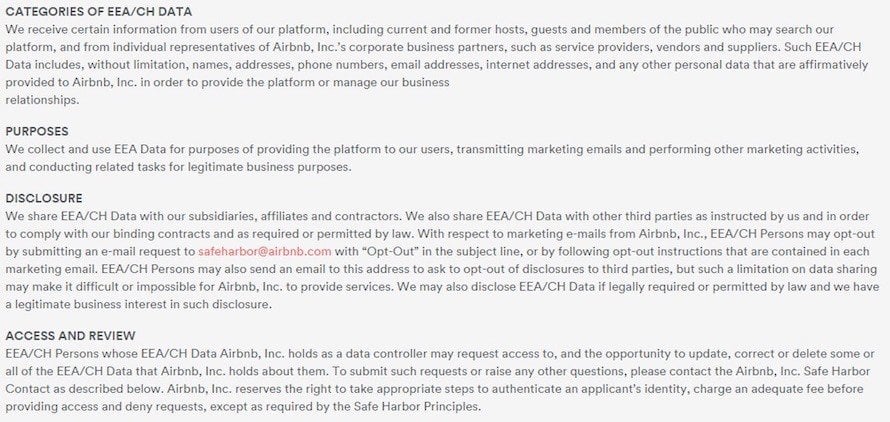

What Is Safe Harbor Termsfeed

Compliance Corner Testing For Safe Harbors In The Qm Rule Part 1

Seven Days March 15 2017 By Seven Days Issuu

Tom Sullivan Shore Power Lawsuit Against Msc Cruises Miami Dade County Pdf Lease Leasehold Estate

Legal Safe Harbor

:max_bytes(150000):strip_icc()/Office2-EbonyHoward-8b4ada1233ed44aca6ef78c46069435d.jpg)

Qualified Mortgage Definition

Safe Harbor 401k Plans Guide For Small Business Owners

What Is Safe Harbor Termsfeed

Homes For Sale In St Pete Beach Pinellas Coastal Home Search

Farm For Sale At 241 Unionville Rd Wantage Nj 07461 Full Details

Links 2 13 2023 Naked Capitalism

:max_bytes(150000):strip_icc()/FullSizeRender-3cce85b0fabd4e18b920f442247f7b87.jpeg)

Qualified Mortgage Definition